All About Insurance: Necessary Insights for Savvy Consumers

Insurance plays an essential function in monetary security and threat administration. Consumers often forget the nuances of numerous kinds of insurance coverage, leading to misconceptions and potential gaps in defense. False impressions can shadow judgment, making it crucial to assess individual requirements and alternatives critically. Recognizing these aspects can greatly impact economic health. Lots of continue to be uninformed of the approaches that can enhance their insurance choices. What insights could reshape their method?

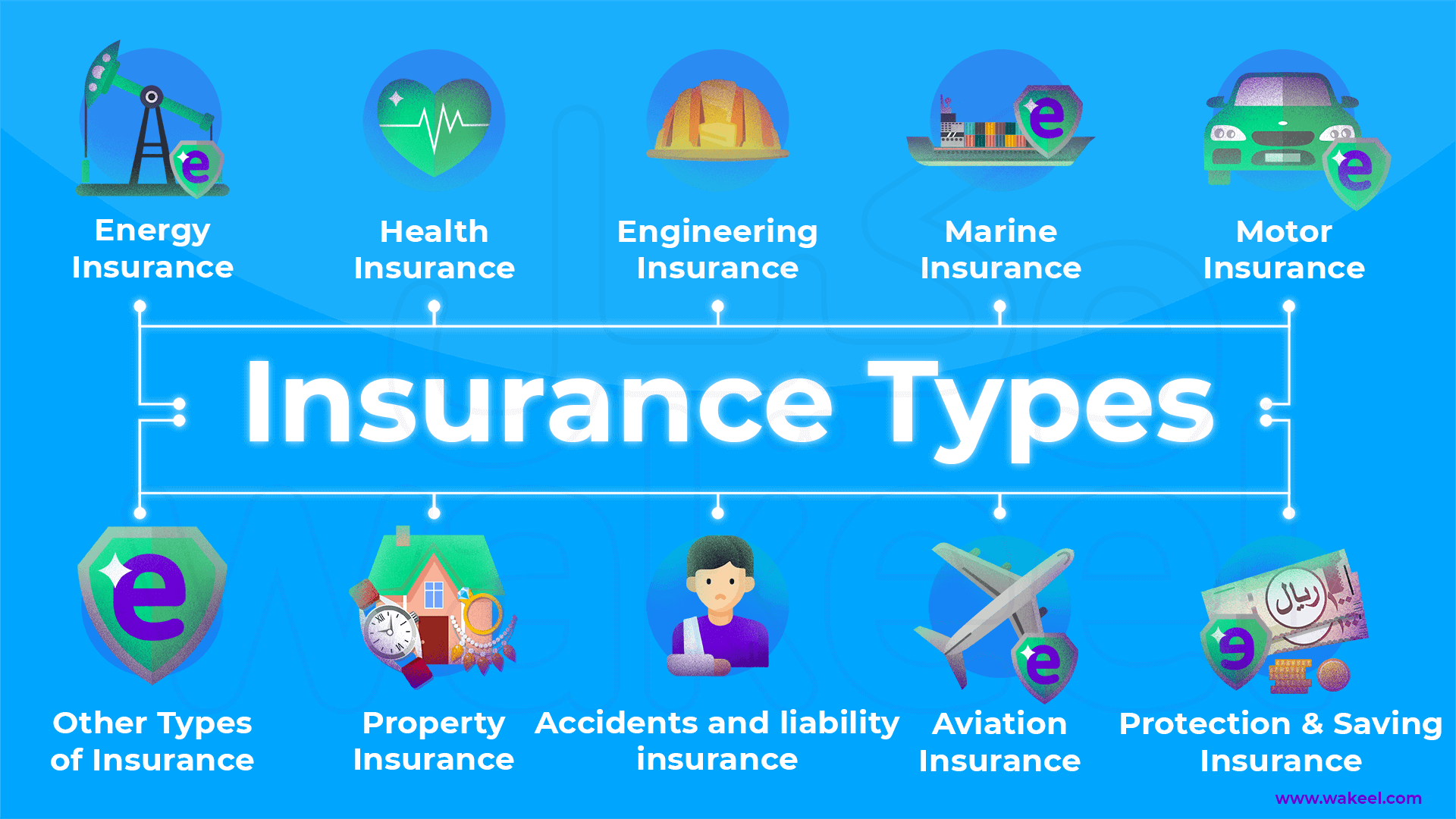

Understanding Various Kinds of Insurance

What kinds of insurance should customers consider to secure their possessions and well-being? Numerous forms of insurance play a fundamental function in securing people and their belongings. Wellness insurance is necessary for covering clinical expenses, ensuring access to needed therapies without monetary problem. House owners insurance shields versus damages to building and obligation claims, while renters insurance uses comparable protection for tenants. Auto insurance is mandated in many locations and covers vehicle-related incidents, offering economic safety in situation of mishaps or theft.

Life insurance policy offers as a monetary safety net for dependents in case of a policyholder's death, assisting safeguard their future. Impairment insurance is crucial for revenue defense during extended health problem or injury, permitting individuals to preserve a standard of life. Lastly, umbrella insurance uses extra obligation protection past typical policies, providing an extra layer of defense versus unforeseen conditions. Each type of insurance addresses particular dangers, making it necessary for consumers to assess their individual demands.

Common False Impressions Concerning Insurance

Just how commonly do customers find themselves misleaded regarding insurance? Several people nurture misunderstandings that can bring about inadequate decisions. A common myth is that all insurance plan coincide, which ignores critical distinctions in coverage, exclusions, and costs. An additional usual belief is that insurance is unneeded for young, healthy and balanced individuals; nonetheless, unanticipated occasions can occur at any age. In addition, some consumers assume filing a claim will instantly lead to higher costs, which is not constantly the situation, as this differs by insurer and specific circumstances. Additionally, lots of think that having insurance indicates they are totally protected versus all potential threats, yet policies frequently have limitations and exemptions. These mistaken beliefs can cause poor insurance coverage or monetary pressure. It is necessary for customers to inform themselves concerning insurance to make educated choices and avoid pitfalls that come from misunderstanding their plans.

Assessing Your Insurance Needs

When establishing insurance requirements, consumers typically wonder where to begin (business insurance agent abilene tx). An extensive assessment starts with reviewing personal circumstances, consisting of economic standing, assets, and possible responsibilities. This includes determining what requires defense-- such as health and wellness, building, and income-- and understanding the dangers related to each

Next off, customers should consider their present protection and any kind of gaps that might exist. Reviewing existing policies helps highlight locations that need additional security or changes. Additionally, life adjustments, such as marriage, home purchases, or parenthood, can considerably change insurance needs.

Involving with insurance specialists is additionally recommended, as they can offer customized advice based upon individual circumstances. Ultimately, the objective is to create a well-rounded insurance profile that straightens with personal goals and provides tranquility of mind versus unexpected events. By taking these steps, customers can determine they are adequately protected without exhausting their finances.

Tips for Selecting the Right Protection

Picking the right insurance coverage can commonly really feel frustrating, yet recognizing essential elements can simplify the process. Consumers must begin by assessing their details requirements, taking into consideration factors like individual assets, wellness status, and way of life. It is necessary to research various sorts of insurance coverage readily available, such as obligation, all-encompassing, or collision, making certain that each option lines up with specific situations.

Cost comparisons among different insurance carriers can disclose considerable distinctions in premiums and coverage restrictions. Looking for quotes from numerous insurance companies can aid determine the finest worth. Additionally, customers should assess plan terms davis vision providers very closely, paying interest to exemptions and deductibles, as these components can impact overall defense.

Consulting with an insurance representative can use personalized insights, guaranteeing that individuals are not forgeting important components. Eventually, making the effort to analyze choices completely brings about informed choices, giving peace of mind and proper coverage customized to one's distinct circumstance.

The Significance of On A Regular Basis Evaluating Your Policies

On a regular basis assessing insurance plan is vital for maintaining appropriate insurance coverage as personal situations and market problems alter. insurance quotes abilene tx. Life occasions such as marital relationship, the birth of a child, or modifications in employment can considerably affect protection demands. Furthermore, shifts on the market, such as boosts in premiums or brand-new plan offerings, might provide much better choices

Consumers need to establish a routine, ideally annually, to assess their plans. This procedure permits individuals to recognize gaps in insurance coverage, verify limits are ample, and get rid of unnecessary plans that might no longer serve their demands. Moreover, assessing policies can bring about potential cost savings, as customers might discover discounts or reduced costs offered through changes.

Ultimately, proactive testimonial of insurance coverage equips customers to make educated decisions, ensuring their coverage aligns with their current lifestyle and financial circumstance. This persistance not just improves security but likewise advertises financial tranquility of mind.

Often Asked Concerns

How Can I Sue With My Insurance Provider?

To sue with an insurance policy copyright, one usually requires to get in touch with the business straight, supply needed paperwork, and comply with the details treatments described in their policy. Timeliness and precision are necessary for effective claims handling.

What Elements Affect My Insurance Costs?

Numerous aspects affect insurance premiums, including the insured person's age, health standing, location, sort of protection, asserts background, and credit history. Insurance providers evaluate these elements to identify risk levels and proper costs rates.

Can I Adjustment My Protection Mid-Policy Term?

Altering coverage mid-policy term is usually possible - business insurance agent abilene tx. Insurance firms usually enable modifications, affecting costs appropriately. Policyholders should consult their read this post here insurance supplier to understand details terms, implications, and potential costs linked with altering their coverage during the plan duration

What Should I Do if My Insurance claim Is Denied?

Exist Discounts for Bundling Multiple Insurance Plan?

Many insurance service providers use discount rates for packing multiple plans, such as home and vehicle insurance. This method can bring about significant financial savings, motivating consumers to combine protection with a single insurance firm for convenience delta dental ins and cost.